(All Private Transactions for private clients)

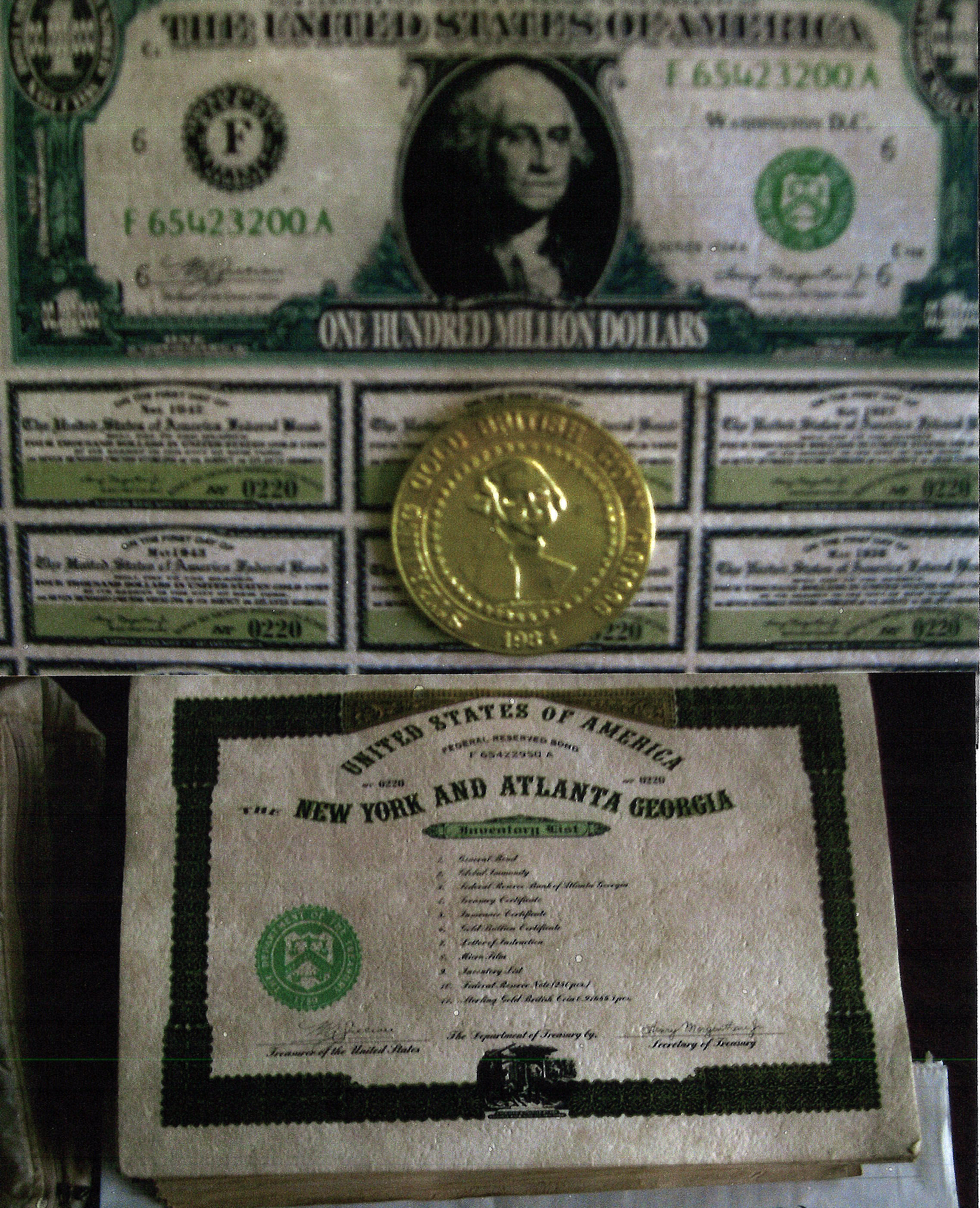

G-20/FED/IMF Authorized Historic Golden Asset Programs 2022-2023

The G-20, The Federal Reserve, the IMF Redemption Committee, and the IMF have assembled several programs for the use and redemption of Gold-Backed Historic Assets in the manner of various bond issues in the past. These assets are now eligible for financial compensation and final settlement under the several programs described hereunder. 1. DOD/UST Historic Asset One-time-payment Program – STATUS – First groups are waiting for release of funds, scheduled authentication at TTM, and contracts. Currently closed to new files and beginning cash settlment in Zurich and Miami.

2. G-20/IMF/FED Historic Asset Private Placement Program – STATUS - The first round has just closed intake and release of funds is scheduled for last week of October.

3. G-20/IMF/FED Historic Asset Purchase/Redemption Program – STATUS - Currently open for intake only via direct and authorized agents.

4. Bank Consortium Historic Asset Purchase/Redemption Program – STATUS – Capacity met, Currently closed for specific menu of assets…

Procedures for Consideration Clients should make a proper asset submission consisting of: - Client Information Sheet

- Description and details of the asset with valuations and insurance info if available.

- Asset storage details/receipt as applies.

- List of the consultants to be registered with the transaction (if applicable)

TPF will review your information for completeness and processed for immediate consideration. You will be contacted directly by TPF with discussion of the details of the proposed tranaction. Final Agreements will follow accordingly.

TPF currently has seven cliets with assets valued at over seventy billion dollars registered wtih this program.

E-mail your questions, completed information, or request details to: thepalatines@web-dynamics.us The Palatine Foundation is acting only as a Promoter of any contemplated transaction as allowed by Securities and Exchange Commission law. All matters in a registered securities transaction are handled only by registered SEC brokers and brokerage firms. |